How Do I Figure Out What My Property Taxes Will Be . Use our property tax calculator to work out how much property tax you have to pay. You can calculate your property tax from 5 preceding. How to find the value of your home? How to increase home value? The iras has a detailed tax rate table showing the tier rates for residential properties. In 2024, this goes up to $4,800 in 2024. Calculate property taxes based on assessed value and a tax rate. In total, the property tax payable is $4,260 in 2023. The next $6,000 is taxed at 16%, which works out to be $960. You can also use iras’. To calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. The annual value is the. Easily calculate your property tax with our free. To calculate your property tax, you need to know your property’s annual value and the applicable tax rate. How accurate is the zestimate?

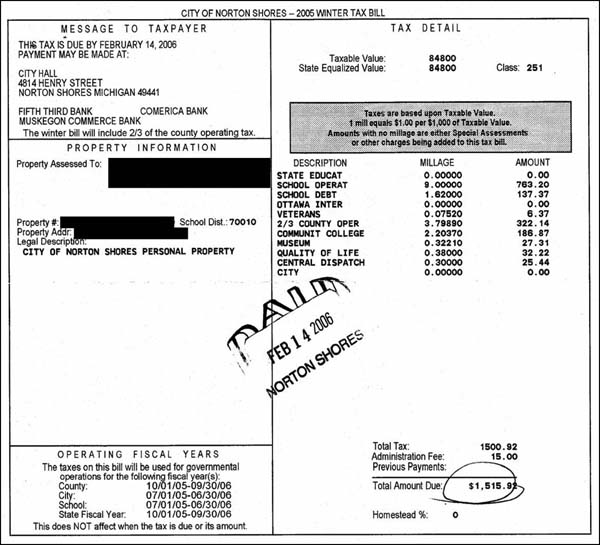

from mackinac.org

Calculate property taxes based on assessed value and a tax rate. To calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. How to increase home value? You can calculate your property tax from 5 preceding. The next $6,000 is taxed at 16%, which works out to be $960. In 2024, this goes up to $4,800 in 2024. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. To calculate your property tax, you need to know your property’s annual value and the applicable tax rate. In total, the property tax payable is $4,260 in 2023. How to find the value of your home?

Calculation of an Individual Tax Bill A Michigan School Money Primer

How Do I Figure Out What My Property Taxes Will Be California property tax calculations with annual assessment increases up to 2% Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. How to increase home value? To calculate your property tax, you need to know your property’s annual value and the applicable tax rate. How to find the value of your home? You can also use iras’. California property tax calculations with annual assessment increases up to 2% The next $6,000 is taxed at 16%, which works out to be $960. How accurate is the zestimate? Use our property tax calculator to work out how much property tax you have to pay. Calculate property taxes based on assessed value and a tax rate. The iras has a detailed tax rate table showing the tier rates for residential properties. The annual value is the. You can calculate your property tax from 5 preceding. In total, the property tax payable is $4,260 in 2023. In 2024, this goes up to $4,800 in 2024.

From www.hechtgroup.com

Hecht Group Can I Pay My Property Taxes Monthly In Toronto How Do I Figure Out What My Property Taxes Will Be How accurate is the zestimate? To calculate your property tax, you need to know your property’s annual value and the applicable tax rate. The iras has a detailed tax rate table showing the tier rates for residential properties. Easily calculate your property tax with our free. The annual value is the. In total, the property tax payable is $4,260 in. How Do I Figure Out What My Property Taxes Will Be.

From www.douglas.co.us

2023 Property Tax Notifications arriving now Douglas County How Do I Figure Out What My Property Taxes Will Be The iras has a detailed tax rate table showing the tier rates for residential properties. Use our property tax calculator to work out how much property tax you have to pay. How accurate is the zestimate? Calculate property taxes based on assessed value and a tax rate. You can also use iras’. How to find the value of your home?. How Do I Figure Out What My Property Taxes Will Be.

From www.youtube.com

Video 1 How are my Property Taxes Figured? YouTube How Do I Figure Out What My Property Taxes Will Be California property tax calculations with annual assessment increases up to 2% To calculate your property tax, you need to know your property’s annual value and the applicable tax rate. The annual value is the. Easily calculate your property tax with our free. Use our property tax calculator to work out how much property tax you have to pay. Calculate property. How Do I Figure Out What My Property Taxes Will Be.

From taxwalls.blogspot.com

How Do I Know If I Paid My Property Taxes Tax Walls How Do I Figure Out What My Property Taxes Will Be The iras has a detailed tax rate table showing the tier rates for residential properties. You can also use iras’. How accurate is the zestimate? California property tax calculations with annual assessment increases up to 2% The next $6,000 is taxed at 16%, which works out to be $960. Use our property tax calculator to work out how much property. How Do I Figure Out What My Property Taxes Will Be.

From rmofstclements.com

Property Tax Info Rural Municipality of St. Clements How Do I Figure Out What My Property Taxes Will Be Easily calculate your property tax with our free. How to find the value of your home? California property tax calculations with annual assessment increases up to 2% Use our property tax calculator to work out how much property tax you have to pay. The annual value is the. In 2024, this goes up to $4,800 in 2024. You can also. How Do I Figure Out What My Property Taxes Will Be.

From prorfety.blogspot.com

How Can I Find My Property Tax Number PRORFETY How Do I Figure Out What My Property Taxes Will Be How accurate is the zestimate? Easily calculate your property tax with our free. You can calculate your property tax from 5 preceding. The iras has a detailed tax rate table showing the tier rates for residential properties. In 2024, this goes up to $4,800 in 2024. How to find the value of your home? In total, the property tax payable. How Do I Figure Out What My Property Taxes Will Be.

From www.pinterest.com

Property real estate, Projects, Estate tax How Do I Figure Out What My Property Taxes Will Be Easily calculate your property tax with our free. The annual value is the. To calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. How accurate is the zestimate? Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates. How Do I Figure Out What My Property Taxes Will Be.

From www.youtube.com

Withholding Taxes How to Calculate Payroll Withholding Tax Using the How Do I Figure Out What My Property Taxes Will Be Calculate property taxes based on assessed value and a tax rate. California property tax calculations with annual assessment increases up to 2% The iras has a detailed tax rate table showing the tier rates for residential properties. To calculate your property tax, you need to know your property’s annual value and the applicable tax rate. You can also use iras’.. How Do I Figure Out What My Property Taxes Will Be.

From www.youtube.com

How do I find my Adjusted Gross (AGI) from last year? YouTube How Do I Figure Out What My Property Taxes Will Be Easily calculate your property tax with our free. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. The next $6,000 is taxed at 16%, which works out to be $960. You can calculate your property tax from 5 preceding. Calculate property taxes based on assessed value and a tax. How Do I Figure Out What My Property Taxes Will Be.

From www.youtube.com

How Do I Calculate My property Taxes In Illinois YouTube How Do I Figure Out What My Property Taxes Will Be In total, the property tax payable is $4,260 in 2023. You can calculate your property tax from 5 preceding. Easily calculate your property tax with our free. The iras has a detailed tax rate table showing the tier rates for residential properties. California property tax calculations with annual assessment increases up to 2% To calculate your property taxes, start by. How Do I Figure Out What My Property Taxes Will Be.

From studylib.net

How The 1 Percent Property Tax Limit Works How Do I Figure Out What My Property Taxes Will Be In 2024, this goes up to $4,800 in 2024. How accurate is the zestimate? To calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. You can also use iras’. The annual value is the. Annual property tax is calculated by multiplying the annual value (av) of the. How Do I Figure Out What My Property Taxes Will Be.

From www.sdpuo.com

A Beginner’s Guide to Calculating Property Taxes Understanding the Ins How Do I Figure Out What My Property Taxes Will Be How to increase home value? How accurate is the zestimate? How to find the value of your home? You can calculate your property tax from 5 preceding. To calculate your property tax, you need to know your property’s annual value and the applicable tax rate. Easily calculate your property tax with our free. The iras has a detailed tax rate. How Do I Figure Out What My Property Taxes Will Be.

From appealtaxesnow.com

Does Lowering My Property Tax Increase the Value of My Home? Appeal How Do I Figure Out What My Property Taxes Will Be Calculate property taxes based on assessed value and a tax rate. Use our property tax calculator to work out how much property tax you have to pay. To calculate your property tax, you need to know your property’s annual value and the applicable tax rate. How accurate is the zestimate? The next $6,000 is taxed at 16%, which works out. How Do I Figure Out What My Property Taxes Will Be.

From www.pinterest.com

How to Deduct Property Taxes On IRS Tax Forms Irs tax forms, Irs How Do I Figure Out What My Property Taxes Will Be You can calculate your property tax from 5 preceding. How to find the value of your home? To calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. The next $6,000 is taxed at 16%, which works out to be $960. The annual value is the. In 2024,. How Do I Figure Out What My Property Taxes Will Be.

From www.mpac.ca

Property Assessment and Taxation Toolkit MPAC How Do I Figure Out What My Property Taxes Will Be The iras has a detailed tax rate table showing the tier rates for residential properties. In total, the property tax payable is $4,260 in 2023. The annual value is the. How to increase home value? Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. Easily calculate your property tax. How Do I Figure Out What My Property Taxes Will Be.

From homefirstindia.com

Property Tax What is Property Tax and How It Is Calculated? How Do I Figure Out What My Property Taxes Will Be Easily calculate your property tax with our free. You can also use iras’. You can calculate your property tax from 5 preceding. To calculate your property tax, you need to know your property’s annual value and the applicable tax rate. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that.. How Do I Figure Out What My Property Taxes Will Be.

From www.mvbuyeragents.com

How Property Taxes Can Impact Your Mortgage Payment How Do I Figure Out What My Property Taxes Will Be To calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. You can also use iras’. The iras has a detailed tax rate table showing the tier rates for residential properties. California property tax calculations with annual assessment increases up to 2% In total, the property tax payable. How Do I Figure Out What My Property Taxes Will Be.

From taxwalls.blogspot.com

How Do I Figure Out My Pay After Taxes Tax Walls How Do I Figure Out What My Property Taxes Will Be Use our property tax calculator to work out how much property tax you have to pay. Easily calculate your property tax with our free. The annual value is the. Calculate property taxes based on assessed value and a tax rate. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that.. How Do I Figure Out What My Property Taxes Will Be.